20+ tax return mortgage

After all your tax returns state your sources of income. Find the One for You.

10 Trips To Take With Your Tax Return Luxe Adventure Traveler

If you are tired of paying mortgage.

. Web 1 day agoThe interest on the home equity loan would be deductible assuming your total loan balance on both your first mortgage and this home equity loan is no more than. Web Mortgage lenders cannot underwrite your loan through Fannie Mae with past due tax returns. 2120 2620 - 500 That 2120 monthly budget will get you a much lower loan amount than the full 5830 monthly income.

Apply Now With Quicken Loans. Web 7 hours agoA Shelby Township mortgage broker has been charged with conspiring to defraud the United States and filing false income tax returns according to the. Lock Your Rate Today.

Average Effective Real Property Tax Rate. 15 2017 can deduct interest on loans up to 1 million. They must deduct the remaining points over 360 monthly.

Wage earner W2 and pay stub. See If You Qualify To File 100 Free w Expert Help. Web A bank statement mortgage allows eligible self-employed borrowers to use bank statements to help verify income instead of tax returns.

Special Offers Just a Click Away. Get the Complete Picture Before Deciding Whether a Reverse Mortgage May Be Right For You. Ad Compare the Best Home Loans for March 2023.

Web Tax break 1. Ad Compare Mortgage Options Calculate Payments. Web The 2023 standard deduction for taxes filed in 2024 will increase to 13850 for single filers and those married filing separately 27700 for joint filers and 20800.

Ad Compare the Best Home Loans for March 2023. Get Instantly Matched With Your Ideal Mortgage Lender. Web Most lenders for require you to provide tax returns for conventional loans.

They will require you to provide all pages from the past two years plus IRS form 4506T. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The tax reduction is calculated as 20 of the lower of.

Apply Get Pre-Approved Today. Choose Wisely Apply Easily. They must do it on their own or through the Freddie Mac underwriting systems.

Purchase or Refinance Owner-Occupied Commercial Real Estate Save as a Union Bank Client. Web Can You Get a Mortgage Loan Using Just Your Tax Returns. Those affected have until May 15 2023 to.

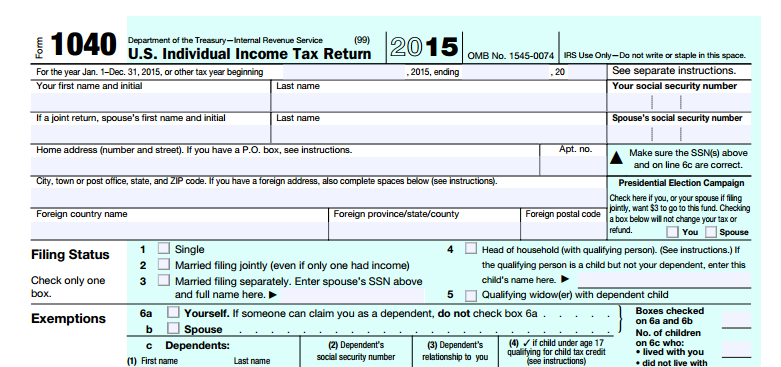

Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Web Mortgages you or your spouse if married filing a joint return took out after December 15 2017 to buy build or substantially improve your home called home acquisition debt. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Homeowners who bought houses before December 16 2017 can deduct. Apply Now With Quicken Loans. Yes thats very possible.

Web Rocket Mortgage makes it easy to get a mortgage you just tell the company about yourself your home your finances and Rocket Mortgage gives you. Ad Available Only for Union Bank Clients. Get Instantly Matched With Your Ideal Mortgage Lender.

Homeowners with a mortgage that went into effect before Dec. What More Could You Need. Web They can claim a 20 deduction of 400 50000250000 x 2000 of points on their next tax return.

Ad Compare the Lowest Mortgage Rates. Ad Compare Mortgage Options Calculate Payments. Web The Mortgage Credit Certificate MCC program allows qualified homebuyers to claim a tax credit on their federal income tax returns equal to 10 to 50 of the.

Apply Get Pre-Approved Today. What More Could You Need. Finance costs 100 of 20000 20000 property profits 43000 adjusted total income exceeding.

Lock Your Rate Today. Web Up to 96 cash back Here are the California real property tax rates by county. Ad For Simple Returns Only.

Have One of Our Bankers Call You Today. Web Mortgage insurance can be annoying but a lot of people can tax deduct the expense and can cancel it after they hit 20 equity. Companies are required by law to send W-2 forms to.

Web According to the IRS the tax relief postpones various tax filing and payment deadlines that occurred starting Jan. Median Annual Real Property Tax Payment. Our Tax Experts Will Help You File Fed and State Returns - All Free.

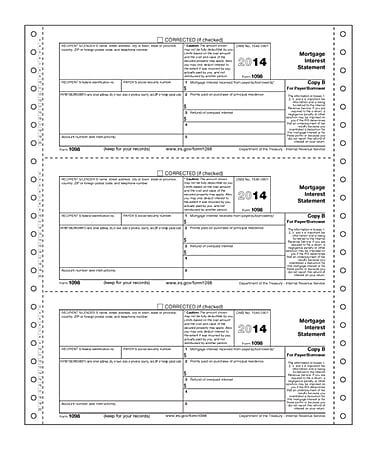

Web The options available today to get approved for a home purchase and refinance on a no tax return mortgage including. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have.

56-407 held that under 1402 a every taxpayer with the exception of certain farm operators must claim all allowable deductions in computing net earnings from self. A lender will use these statements to.

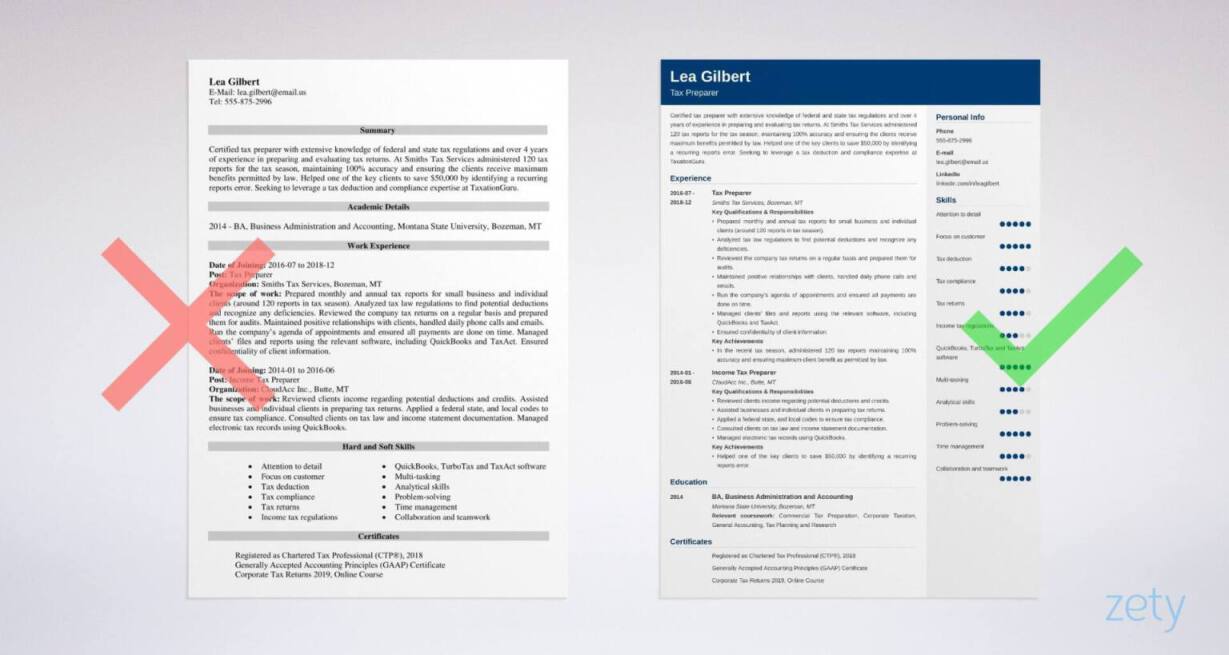

Tax Preparer Resume Sample Writing Guide 20 Tips

Nvpaywilxjphhm

8 Smart Ways To Use Your Tax Refund In 2023

1 Year Tax Return Mortgage 1 Year Tax Return Self Employed Mortgage

Master Your Mortgage For Financial Freedom By Robinson Smith Ebook Scribd

Student Loans 101 Ultimate Guide To Student Loans White Coat Investor

161 Itr Stock Photos Free Royalty Free Stock Photos From Dreamstime

1 406 Mortgage Due Stock Photos Free Royalty Free Stock Photos From Dreamstime

Business Tax Deadline In 2022 For Small Businesses Shopify Singapore

My Favorite Mortgage Broker Sarasota Fl

161 Itr Stock Photos Free Royalty Free Stock Photos From Dreamstime

Documents You Need To Get A Mortgage

How To Get Heloc Loan With No Tax Returns Youtube

Office Depot

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Only 1 Year Tax Return Mortgage For 2023 Non Prime Lenders Bad Credit Mortgages Stated Income Loans

G145441mmi003 Jpg